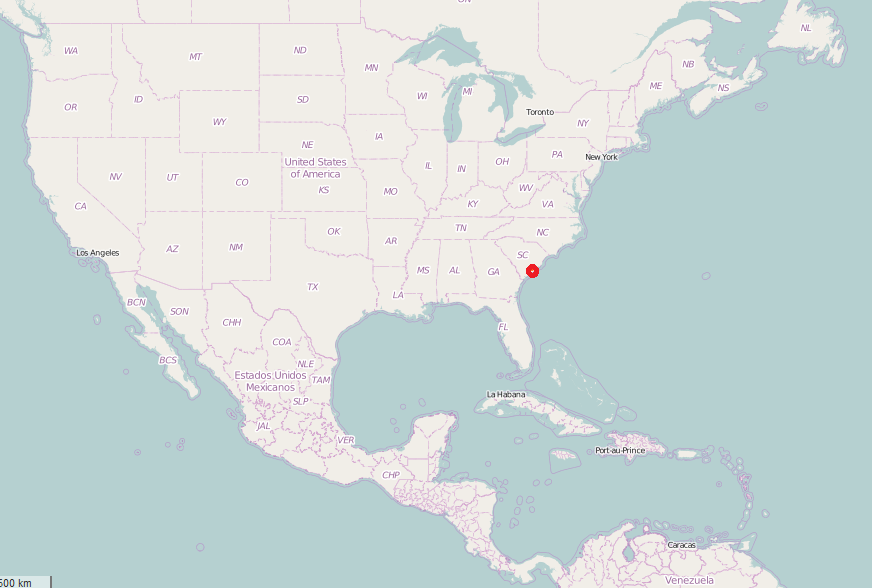

The Port of Charleston, operated by the South Carolina Ports Authority (SCPA), stands as a high-efficiency gateway and a finely tuned logistics engine powering the American Southeast’s advanced manufacturing and automotive industries. For importers shipping parts and goods from China, the Port of Charleston offers a unique combination of highly efficient terminal operations, modern infrastructure, and a seamless connection to inland production facilities. Its strong reputation for reliability and high performance makes it the preferred gateway for global companies that depend on precision and just-in-time supply chains. This article explores the port’s resilient performance, its innovative inland port network, and its state-of-the-art terminals.

A Vital Artery for the Southeast’s Industrial Heartbeat

The Port of Charleston, operated by the South Carolina Ports Authority (SCPA), is more than just a seaport; it is a finely tuned logistics engine powering the American Southeast’s advanced manufacturing and automotive industries. For importers shipping parts and goods from China, the Port of Charleston offers a unique combination of highly efficient terminal operations, modern infrastructure, and a seamless connection to inland production facilities.

Its reputation for reliability and high performance makes it the preferred gateway for global companies that depend on precision and just-in-time supply chains.

Resilient Performance and Key Metrics (FY 2024)

While global trade normalizes from post-pandemic highs, the Port of Charleston shows underlying market strength, particularly in its connection to the manufacturing sector.

| Metric | Fiscal Year 2024 |

|---|---|

| Total Annual TEUs Handled | ~2.5 Million |

| Inland Port Greer Growth | +28% (Record Year) |

| Vehicles Handled | +12% |

Source: South Carolina Ports Authority (SCPA), Global Trade Magazine

The Inland Port Advantage: Seamless Ship-to-Rail Service

The Port of Charleston’s most innovative feature is its network of inland ports. Inland Port Greer, located in upstate South Carolina, is a prime example.

- Direct Factory Connection: Inland Port Greer extends the port’s reach 212 miles inland via a dedicated rail service. This allows international cargo to be moved directly from the ship to the heart of the manufacturing region.

- Automotive Hub: The facility is a critical logistics hub for South Carolina’s booming automotive cluster, serving major manufacturers with speed and reliability. In FY2024, it handled a record 187,638 containers.

- Efficiency and Reliability: This ship-to-rail model reduces truck traffic, lowers transportation costs, and provides a highly reliable supply chain for components arriving from China and other international locations.

This system demonstrates deep Expertise and Authority in creating tailored logistics solutions for high-stakes industries.

State-of-the-Art Terminals: Leatherman and Wando Welch

SC Ports has invested heavily to ensure its terminals are among the most modern and capable in the nation.

- Hugh K. Leatherman Terminal: As the newest container terminal in the United States, the Leatherman Terminal offers significant new capacity and is equipped with some of the tallest ship-to-shore cranes on the East Coast, easily handling the largest vessels.

- Wando Welch Terminal: This workhorse terminal continues to be a hub of activity, undergoing continuous upgrades to maintain its high standard of operational excellence.

Shipping Costs from China to Port of Charleston

Understanding the shipping costs from China to the Port of Charleston is crucial for businesses targeting the Southeast’s manufacturing and automotive industries. These costs are dynamic and influenced by various factors, including the type and volume of cargo, the chosen shipping method (Sea Freight or Air Freight), current market conditions, fuel prices, and specific surcharges.

Factors Influencing Shipping Costs

Several key elements contribute to the overall cost of Shipping from China to USA via the Port of Charleston:

- Incoterms: The agreed-upon International Commercial Terms (Incoterms) define who is responsible for costs and risks at various stages of the journey. This significantly impacts the final price. For example, FOB (Free On Board) places more responsibility on the buyer, while DDP (Delivered Duty Paid) means the seller covers almost all costs up to the destination, often associated with Door to Door Shipping.

- Cargo Type and Volume: The nature of your goods (e.g., general cargo, hazardous materials, oversized cargo like OOG Freight or Breakbulk Freight) and their volume (measured in TEUs for containers or cubic meters for LCL shipments) directly affect freight rates.

- Fuel Surcharges (BAF/FAF): Bunker Adjustment Factor (BAF) or Fuel Adjustment Factor (FAF) are surcharges added by carriers to account for fluctuations in fuel prices.

- Peak Season Surcharges (PSS): During high-demand periods, especially before major holidays like Chinese New Year or the year-end shopping season, carriers may impose PSS.

- Port Charges: These include terminal handling charges (THC), demurrage, and detention fees at both the origin and destination ports.

- Customs Duties and Taxes: Importers are responsible for paying applicable duties and taxes upon customs clearance in the U.S.

- Ancillary Services: Costs for warehouse storage, insurance, inland transportation (Road Freight), and specialized handling will add to the total.

Estimated Shipping Costs from Major Chinese Ports to Charleston

The following table provides estimated sea freight costs for both Full Container Load (FCL) and Less than Container Load (LCL) shipments from key Chinese ports to the Port of Charleston. Please note that these figures are estimates and can vary significantly based on real-time market conditions, carrier availability, and specific service requirements. For precise and up-to-date quotes, it is always recommended to contact Dantful International Logistics.

| Origin Port (China) | Estimated FCL Cost (20ft Container) | Estimated FCL Cost (40ft Container) | Estimated LCL Cost (per CBM) |

|---|---|---|---|

| Shanghai | $2,650 – $4,150 | $3,650 – $5,750 | $88 – $128 |

| Ningbo | $2,550 – $4,050 | $3,550 – $5,650 | $85 – $125 |

| Shenzhen | $2,750 – $4,300 | $3,750 – $5,900 | $92 – $132 |

| Guangzhou | $2,700 – $4,200 | $3,700 – $5,800 | $90 – $130 |

| Qingdao | $2,450 – $3,950 | $3,450 – $5,550 | $78 – $118 |

| Tianjin | $2,350 – $3,850 | $3,350 – $5,450 | $75 – $115 |

| Xiamen | $2,600 – $4,100 | $3,600 – $5,700 | $85 – $125 |

Note: These are general estimates for port-to-port sea freight and do not include customs duties, taxes, insurance, or inland transportation costs. Prices are subject to change based on market volatility and specific service requirements.

Transit Times from China to Port of Charleston

Predictable transit times are crucial for efficient inventory management and supporting the just-in-time supply chains of the Southeast’s manufacturing sector. The journey from China to the Port of Charleston involves various stages, and understanding the typical durations for different shipping methods is key to successful logistics planning.

Factors Affecting Transit Times

Several factors can influence how long your cargo takes to reach Charleston from China:

- Shipping Method: Sea Freight is generally the most economical but slowest, while Air Freight offers significantly faster delivery at a higher cost.

- Direct vs. Transshipment: Direct routes are faster. Transshipment (where cargo is transferred between vessels at an intermediate port) adds time due to layovers and additional handling.

- Vessel Speed and Route: Different shipping lines operate vessels with varying speeds and follow different routes, impacting overall transit time.

- Port Congestion: High volumes of cargo or unforeseen events can lead to delays at origin or destination ports.

- Weather Conditions: Adverse weather can cause delays at sea or in port operations.

- Customs Clearance: Efficient customs clearance processes are crucial. Delays here can significantly impact overall transit time.

Estimated Transit Times from Major Chinese Ports to Charleston

The following table provides estimated transit times for both sea freight and air freight from major Chinese ports to the Port of Charleston. These are general guidelines, and actual times may vary.

| Origin Port (China) | Estimated Sea Freight Transit Time | Estimated Air Freight Transit Time |

|---|---|---|

| Shanghai | 29 – 39 days | 5 – 8 days |

| Ningbo | 29 – 39 days | 5 – 8 days |

| Shenzhen | 27 – 37 days | 4 – 7 days |

| Guangzhou | 27 – 37 days | 4 – 7 days |

| Qingdao | 31 – 41 days | 6 – 9 days |

| Tianjin | 32 – 42 days | 6 – 9 days |

| Xiamen | 28 – 38 days | 5 – 8 days |

Note: Sea freight times are port-to-port estimates. Air freight times typically include airport-to-airport transit. Both exclude potential delays from customs clearance or unforeseen circumstances.

Dantful: Your Partner for Charleston’s Manufacturing Corridor

To effectively leverage the Port of Charleston’s unique manufacturing-focused ecosystem, you need a logistics partner that understands the demands of industrial supply chains. Dantful International Logistics provides a highly professional, cost-effective, and high-quality one-stop service.

We specialize in creating seamless logistics plans that integrate ocean freight from China with SCPA’s inland port network. Our precision and reliability ensure your components and materials arrive on schedule, supporting the just-in-time needs of the most demanding manufacturing operations when Shipping from China to USA.

Contact Dantful International Logistics today to connect your business to the heart of Southeast manufacturing through the Port of Charleston.